apparel |

- Footwear & Apparel Industry to Gain From Digital Enhancements - Zacks.com

- The resale apparel market is set to hit $51 billion in 5 years: Report - Yahoo Finance

- Mid-State students seek career apparel donations - Hub City Times

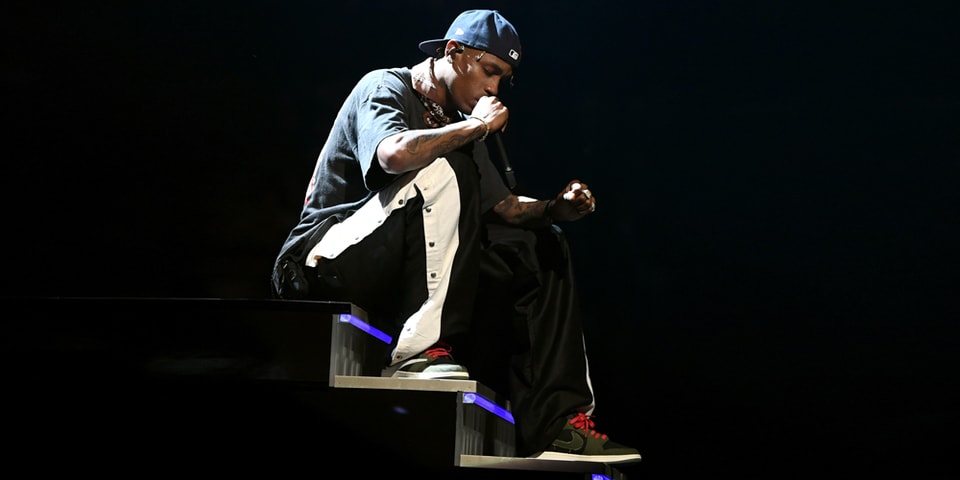

- Travis Scott Will Reportedly Release an Apparel Collection With Jordan Brand - Complex

- Travis Scott Is Reportedly Working on an Apparel Release With Jordan Brand - HYPEBEAST

| Footwear & Apparel Industry to Gain From Digital Enhancements - Zacks.com Posted: 18 Mar 2019 09:00 PM PDT The Zacks Shoes and Retail Apparel industry comprises companies that design, source and market clothing, footwear and accessories for men, women and children, under various brand names. The product offerings of these companies mostly include athletic and casual footwear, fashion apparel and active-wear, sports equipment, bags, balls, as well as other sports and fashion accessories. These companies showcase their products through their own branded outlets and websites. However, some companies also distribute products via other retail stores, such as national chains, online retailers, sporting goods stores, department stores, mass merchandisers, independent retailers and catalogs. Here are the three major themes in the industry:

The Zacks Shoes & Retail Apparel Industry is a 13-stock group within the broader Zacks Consumer Discretionary Sector. The industry currently carries a Zacks Industry Rank #25, which places it at the top 10% of more than 250 Zacks industries. The group's Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates continued outperformance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. Our proprietary Heat Map shows that the industry's rank has improved considerably over the past eight weeks.

The industry's positioning in the top 50% of the Zacks-ranked industries is a result of positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group's earnings growth potential. In the past three months, the industry's earnings estimate for the current year has moved up nearly 2.2%. Before we present a few stocks that you may want to consider for your portfolio, let's take a look at the industry's recent stock-market performance and valuation picture. Industry Outperforms Shareholder Returns The Zacks Shoes and Retail Apparel Industry have outperformed both the S&P 500 and its own sector over the past year. While the stocks in this industry have collectively gained 25.5%, the Zacks S&P 500 Composite and Zacks Consumer Discretionary Sector have rallied 4.6% and 0.3%, respectively. One-Year Price Performance

Shoes and Retail Apparel Industry's Valuation On the basis of forward 12-month Price-to-earnings (P/E) ratio, which is commonly used for valuing Consumer Discretionary stocks, the industry is currently trading at 25.06X compared with the S&P 500's 16.83X and the sector's 18.25X. Over the last five years, the industry has traded as high as 26.49X, as low as 18.63X, and at the median of 22.52X, as the chart below shows. Price-to-Earnings Ratio (Past 5 Years)

Bottom Line We expect the demand for health and fitness-related goods, including athletic footwear and apparel, to be on the rise due to increased consumer health awareness. Additionally, the industry is poised to gain from the introduction of innovative products and growing ease of shopping through robust omni-channel capabilities. Furthermore, a strong economy, with rising consumer spending, will benefit stocks in this consumer-driven industry. While only one stock in the Zacks Shoes & Retail Apparel universe currently sports a Zacks Rank #1 (Strong Buy), we have also mentioned three more stocks with a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here. Let's have a look at them. Deckers Outdoor Corporation (DECK - Free Report) : The current fiscal-year consensus EPS estimate of this Goleta, CA-based company has been unchanged for the last seven days. This Zacks Rank #1 stock has rallied 56.9% in the past year. Price and Consensus: DECK

Rocky Brands Inc. (RCKY - Free Report) : This Nelsonville, OH-based footwear and apparel company has climbed 29% over the past year. The Zacks Consensus Estimate for the current-year EPS has been revised 1.5% upward in the last 30 days. The company currently carries a Zacks Rank #2. Price and Consensus: RCKY

NIKE Inc. (NKE - Free Report) : The stock of this Beaverton, OR-based company has gained 31.5% in the past year. The Zacks Consensus Estimate for the current-year EPS has been unrevised in the last 30 days. The company holds a Zacks Rank #2, at present. Price and Consensus: NKE

Skechers U.S.A. Inc. (SKX - Free Report) : The stock of this California-based company has surged 47.9% in three months' time. The consensus EPS estimate for the current year remained unrevised over the last week. Currently, the company carries a Zacks Rank #2. Price and Consensus: SKX

Zacks' Top 10 Stocks for 2019 In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year? Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%. |

| The resale apparel market is set to hit $51 billion in 5 years: Report - Yahoo Finance Posted: 19 Mar 2019 03:00 AM PDT The resale apparel business is booming. According to thredUP's 7th annual resale report, the current total secondhand market is about $24 billion — that number is expected to hit $51 billion by 2023.  View photos Resale to drive growth in the secondhand apparel market. The report was put together by thredUP, an online resale shopping platform, with research and data from GlobalData, a third-party research and analytics firm. Over 2,000 American women over the age of 18 were surveyed in January. They were asked questions about their shopping habits and preferences for secondhand items. According to the report, 56 million women purchased secondhand products in 2018, up from 44 million women in 2017. "The data really speaks for itself. This year more than ever, you can see how much secondhand is starting to capture the attention of mainstream shoppers," James Reinhart, co-founder and CEO of thredUP, told Yahoo Finance. Moreover, 51% of resale shoppers indicated that they plan to spend more on secondhand in the next five years. "Once people start buying secondhand, they buy more of it over time. When the consumer has that experience of buying a Theory dress for $20 versus $300, they can't imagine going back there and paying full prices," Reinhart said. ThredUP and GlobalData found that resale has grown 21x faster than the retail apparel market over the past three years. In an environment where traditional retailers continue to struggle to adapt to changing consumer tastes, companies like Rent The Runway, thredUP, The RealReal and Poshmark are capitalizing on the idea that consumers are constantly looking for affordability and variety. "We are calling it the end of long-term ownership. The number of items in a consumer's closet continues to decline. People are moving toward a world where their closet is on constant rotation," Reinhart said. Growth opportunitiesWall Street has started to take notice to the growth opportunities within resale apparel. In a note to clients on March 15, Piper Jaffray compiled nine key themes that investors should pay attention to for the future retail industry. One of the themes is the resale economy. "These [resale] platforms see a high level of consumer engagement ... We believe the resale industry and its impact on primary markets will be something to watch over the coming years," analyst Erinn Murphy said. In addition, cohabitation between brands and consignment sellers can potentially benefit parties involved, said Rati Levesque, chief merchant at The RealReal, an online consignment platform that resells of luxury products. "Primary market brands have started to realize that consignment players are helping extend the discovery, reach, and covet-ability of their brands. An item with a strong resale value can strengthen the brand as a whole," Levesque told Yahoo Finance.  View photos Brands with best overall resale value. (thredUP/GlobalData) The 10 brands with the best overall resale value include mid-tier designer brand Kate Spade, owned by Tapestry (TPR), and athleisure brand Lululemon (LULU). "People resell or clean out their closets for all sorts of reasons. Lululemon is a good example of a brand with strong residual value," thredUp's Reinhart said. The Marie Kondo effectAuthor Marie Kondo and the KonMari method have captivated the public since the debut of her book "The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and Organizing" in 2011. After Netflix released a special series about Kondo at the end 2018, thredUP saw a noticeable surge in business. "When her Netflix special came out in December, we saw a huge spike in people looking to clean out their closets after watching that show," Reinhart said. After Kondo's first show, thredUp saw an 80% surge in Clean Out Kits, bags the company sends to customers to send in their items for possible sale. Environmentally-conscious shoppingConsumers are also more conscious about sustainability and ethically-sourced fashion, the study found. In 2013, 57% of consumers preferred to purchase from environmentally-friendly brands. That number jumped to 72% in 2018. "The apparel industry is still the second largest industrial polluter –– we'd like to see this change. The resale market is an excellent way to create a circular economy and reduce the environmental impact," Levesque said. "I'd like to see more brands explore circular economy models and tap resale. It doesn't have to involve us — it's bigger than us. I'm hoping that what we're doing will inspire others to think more responsibly about how we produce and consume fashion." — Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung. Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit. More from Heidi: These are the three biggest risks to the U.S. economy: El-Erian Here's why Wall Street isn't excited about the Tesla Model Y Women's equality could add up to $28 trillion to global GDP: BAML This bull market may be the longest, but it's not the strongest JPMorgan analyzed 25,000 transcripts and found these 5 market trends |

| Mid-State students seek career apparel donations - Hub City Times Posted: 19 Mar 2019 07:50 AM PDT  For the Rapids City Times WISCONSIN RAPIDS – Mid-State Technical College's Administrative Office Procedures class students are coordinating a business/career attire clothing drive. Clothing donations will be given to individuals during the College's Dress 4 Success event in April to jumpstart the job interview process and their new career. The community is invited to make donations of gently used men's and women's business clothing during the drive, March 25-April 22. Acceptable items include men's and women's business suits, dress pants or khakis, shirts, blouses, polo shirts, ties, skirts, dresses, dress shoes (like-new only), new colored dress socks and accessories such as jewelry, purses, belts, coats or jackets. Collection boxes are located in the Student Services & Information Center at Mid-State's campuses in Adams, Marshfield, Stevens Point and Wisconsin Rapids. More information is provided at mstc.edu/clothingdrive. |

| Travis Scott Will Reportedly Release an Apparel Collection With Jordan Brand - Complex Posted: 19 Mar 2019 02:47 PM PDT  Travis Scott has quickly become one of the most influential figures in the sneaker world with his relationship with Nike and Jordan Brand having produced some of the most coveted collaborations over the past few years like his Houston Oilers-inspired Air Jordan IV or customizable Air Force 1 Lows. His redesigned Air Jordan I is also already being considered one of 2019's best releases and hasn't even received its wide release yet. According to @pyleaks on Twitter, La Flame's relationship with the Jumpman will extend into the clothing world in 2019. The Houston emcee will reportedly be releasing a collection of apparel later this year. The capsule is said to include essentials with premium material upgrades: washed suede pullover hoodies, shorts, and a T-shirt. The sportswear pieces will release in olive green, a staple color in Scott's wardrobe, with the hoodie slated to release in grey as well. The hoodie is said to be emblazoned with a variation on the image of MJ's legendary free throw line dunk in the 1988 NBA Slam Dunk Contest. A skeleton will don a red jersey, Scott's trademark box braids, and be positioned in front of two of the rapper's signature motifs, cacti and fire. This move for the Astroworld rapper to get his own clothing collaboration with Jordan Brand is not a surprising one. He is also known as a modern style icon of sorts and his tour merch is some of the most in-demand on the market today. While no official images of the Travis Scott x Jordan Brand apparel have surfaced just yet, @pyleaks reports the items can be expected to hit select retailers in September 2019 for $75-$150. |

| Travis Scott Is Reportedly Working on an Apparel Release With Jordan Brand - HYPEBEAST Posted: 19 Mar 2019 08:55 PM PDT  According to PY_RATES, Travis Scott and Jordan Brand are currently working on an apparel release slated for release this year. Building on their collaborative relationship which saw La Flame put his spin on iconic Air Jordans, the rumored capsule is said to feature streetwear essentials crafted of premium materials. Hoodies, T-shirts and shorts will be done in washed suede sporting olive and grey tones commonly associated with Travis' wardrobe. Additionally, the items will come decorated with a macabre graphic that pays homage to Michael Jordan's iconic 1988 NBA Slam Dunk Contest free throw line dunk. The skeleton representation of MJ will don Travis' signature braids and come surrounded by cacti and flames. Stay tuned for more details as they become available. In case you missed it, Travis Scott's "Sicko Mode" has now spent 32 Weeks on the Billboard Hot 100 chart.

|

| You are subscribed to email updates from "apparel" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

.jpg)

.jpg)

0 Yorumlar